Nationwide Biweekly Administration, Inc. Successfully Completes SSAE 16 Type II Audit

Nationwide Biweekly Administration, Inc. Successfully Completes SSAE 16 Type II Audit

November 18, 2013—Xenia, OH—Nationwide Biweekly Administration, Inc. (“NBA”), one of the nation’s largest and most recognized biweekly program administrators, announced today that it has successfully completed its first SSAE 16 Type II audit. NBA’s compliance with the SSAE 16 audit demonstrates its high level of commitment to solid operating procedures while maintaining the highest level of internal controls.

SSAE 16 is an internationally recognized third-party assurance audit for service providers. SSAE 16 is a new reporting standard for services organizations put forth by the Auditing Standards Board (ASB) of the American Institute of Certified Public Accountants (AICPA). As part of the audit, a number of operating controls related to NBA’s internal policies and procedures were examined. These controls include: company wide management systems, policies and procedures, network operations, customer data integrity and security, and computer controls.

“Receiving this important designation from a top auditing firm reaffirms NBA’s commitment to our customers and business partners, said Daniel Lipsky, President, NBA. “Through strict adherence to compliance and internal controls we’re able to provide peace of mind and world-class service to our customers.”

ABOUT NATIONWIDE BIWEEKLY ADMINISTRATION, INC.

Nationwide Biweekly Administration, Inc., located in Xenia, Ohio, provides payment service and processing to the general public through the Interest Minimizer program. Established in 2002, NBA is licensed and bonded and is registered with FinCEN as a money services business.

For more information about NBA, visit http://www.nbabiweekly.com, like the Facebook page at http://www.facebook.com/nationwidebiweekly.

Nationwide Biweekly Administration Business Tour

Take a tour of Nationwide Biweekly Administration, and see why the administrator of Interest Minimizer bi-weekly mortgage program gets an A+ rating from the Better Business Bureau

(Transcription Below)

Welcome to the headquarters of Nationwide Biweekly Administration, an American company based in beautiful Xenia, Ohio. We’re proud to be the nation’s largest privately held bi-weekly payment administrator. As a fully licensed and bonded company registered with FinCEN as a money transmitter, we process billions of dollars in payments to over 5000 financial institutions. In fact, we process millions of transactions for hundreds of thousands of customers just like you.

When you partner with Nationwide Biweekly, you’ll quickly understand why our size, stability, quality, and professionalism have earned us an A+ rating from the Better Business Bureau. When you call to inquire about the benefits of our Interest Minimizer and Advanced Interest Minimizer programs, you are connected with one of our professionally trained savings analysts. They’re skilled at assisting people. And dramatically, reducing interest charges and paying off all kinds of debts faster including mortgages, home equity loans, credit cards, auto loans, student loans, virtually any interest bearing loan.

To ensure that we deliver world class service to you, Nationwide Biweekly hires only the best talent available in our area. That’s why we pay our savings analysts well above industry average which ensures high quality employees and low turnover. This means you will have professional, qualified, and enthusiastic people working on your behalf to save you from wasting money on unnecessary interest charges. Our savings analysts are provided a four-week classroom training program, ongoing mentor training and call monitoring, state of the art computers and software systems, access to our industry leading client management application, proprietary interest minimizer savings analysis software, professionally developed educational customer videos.

After you become a Nationwide Biweekly customer, you are assigned to our courteous and friendly customer service department. We ensure that Nationwide Biweekly has only the best, brightest, and most customer-oriented employees. It’s one of the keys to our success. During our rigorous three-step interview process, applicants are evaluated to ensure they have the aptitude and attitude to assist customers with their financial needs. The results of our commitment to providing high quality customer service have paid off. We randomly surveyed 743 of our customers and asked three important questions. Here are the results.

Was the representative professional and helpful? 99.3% of those surveyed answered yes. Are you satisfied with the benefits of the bi-weekly program? 97.3% answered yes. Would you recommend our company to someone else? 96.4% said, yes they’d recommend us. That’s quite a testament to our dedicated employees and their desire to deliver high levels of customer satisfaction and it means you can expect to receive this same level of customer service, too. We maintain this standard of excellence by having all employees undergo a rigorous training curriculum.

Once hired, new employees participate in a comprehensive 60-day orientation with the first 30 days spent in training classes being trained, mentored, and tested by our corporate trainers. As part of our ongoing training efforts, Nationwide Biweekly supervisors call our analysts and customer service representatives posing as actual customers to give them real world experience. We record the calls and play them back in one-on-one coaching sessions. That way, we ensure that not only are our representatives friendly, courteous, and professional, they are also knowledgeable and skilled at answering your questions.

Our employees genuinely enjoy working at Nationwide Biweekly and working with each other. Our facilities are designed to provide a safe, secure, and fun place to work. The bottom line is happy employees make better employees, and that benefits everyone. Thank you for taking a tour of Nationwide Biweekly, an American company offering innovative money saving services to hardworking people just like you. From our dedicated professional staff to our world-class customer service, industry leading tools and rigorous training, we are on a mission to help millions save billions.

Nationwide Biweekly Administration Earns BBB Accreditation

Nationwide Biweekly Administration Is Committed to BBB’s Standards of Trust

This week, Nationwide Biweekly Administration announced its recent Accreditation by your Better Business Bureau of Dayton/Miami Valley, Inc. As a BBB Accredited Business, Nationwide Biweekly Administration is dedicated to promoting trust in the marketplace. Its Accreditation will help people understand who the organization is and the core values it believes in. You can check out Nationwide Biweekly Administration’s BBB reliability report by visiting www.bbb.org or calling (937) 222-5825 or (800) 776-5301.

John North, BBB president and CEO, says, “BBB Accreditation is an honor. It’s voluntary and Accredited Businesses must meet and maintain your BBB’s Standards of Trust, a comprehensive set of policies, procedures and best practices representing trustworthiness in the marketplace. The standards call for building trust, embodying integrity, advertising honestly and telling the truth, being transparent, honoring promises, being responsive and safeguarding privacy.”

He continues, “Businesses that meet your BBB’s high standards are invited to apply for Accreditation. Applicants undergo a review process and ultimate approval by your BBB’s Board of Directors. According to Princeton Research, seven in ten consumers say they are more likely to buy from a company designated as a BBB Accredited Business.”

“We are proud to have met your BBB’s high standards and we’re excited to be part of an organization that exists so consumers and businesses alike have an unbiased source to guide them on matters of trust,” said Daniel Lipsky ”We value building trust with our customers and our Accreditation gives our customers confidence in our commitment to maintaining high ethical standards of conduct.”

Daniel Lipsky continues, “Our Accreditation signifies our commitment to customer service, reliability and trust. For any organization to excel in today’s environment, it’s critical it be fully committed to excellence. Our acknowledgement by your BBB aligns with and supports our efforts of providing superior service in the marketplace.”

About Nationwide Biweekly Administration

Nationwide Biweekly Administration is one of the nation’s largest and most recognized administrators for biweekly programs. Through their Interest Minimizer Program, NBA processes billions of dollars worth of mortgage payments for hundreds of thousands of customers. All payments are securely processed through the Federal ACH Banking System with their banking partners.

Educate your kids financially

You can never teach your children about money too soon!

You may have noticed, children may act as money grows on trees! Kids may be aware that you go to the bank to get money, but rarely they know how the money gets there. This is the perfect opportunity to teach your kids that you have to work hard to earn the money that you spend. Once they understand this concept they may become aware of the hard work you put in to earn a living.

Once they learn, they will apply

After your kids learn about money, how its earned, and the things it can buy; you might notice they will save every penny they can get their hands on. As a parent it is your responsibility to channel the attitude to teach them to save and learn delayed gratification.

-Planting the seeds early will help bear fruit later

Educate your children from a young age on how money is earned and how it works. By doing this you can avoid trying to teach them as teenagers, when they are less likely to heed any kind of advice you give.

Allowance can be an effective teaching tool

Giving your kids a small amount of money at a young age will prep them for the larger future numbers to come.

The teaching game changes with Teenagers and College-age kids

By the time the kids reach this age group they will most likely have bigger responsibilities such as: Checking accounts, Credit Cards, and other debt. Teaching the kids about banking and credit while in high school will set them on the path of success when they venture out on there own. High School, a lot of times, will off classes covering banking, financing, and the market. Teach your children to take advantage of these resources.

Fast Facts About Student Loans

Fast Facts About Student Loans

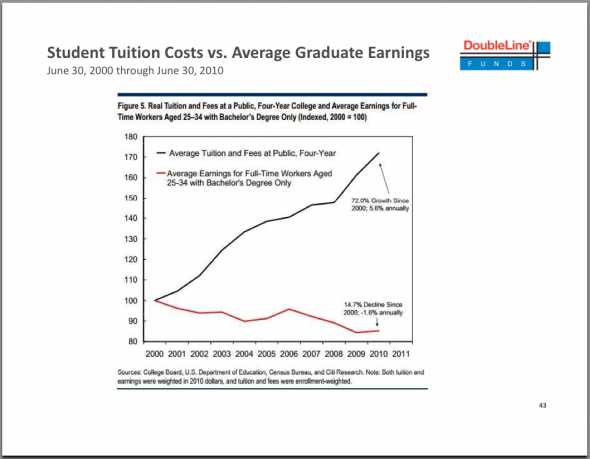

Now more than ever, student loans have become one of the biggest issues that Americans are facing. College cost are rising and outstanding student loans have grown to $1 trillion. And as if that is not worse enough, average graduate earnings of full-time employees aged 25-34 are falling, causing more student loan debtors to fall behind on their payments.

from the Business Insider article: GUNDLACH: These 4 Charts Show How Student Loans Have Become A Real Problem http://www.businessinsider.com/jeff-gundlachs-student-loan-charts-2012-12?op=1

If you are a student loan borrower yourself, read these fast facts on student loans from The Financial Services Roundtable. Be sure to visit their website to learn more about the student loan debt situation in the U.S.

- More Americans are attending college at a time when college is getting more expensive.

Many students borrow money to pay for a college degree.

- Student loans are now the largest form of consumer debt outside of home mortgages, eclipsing both auto loans and credit cards, according to the Federal Reserve Bank of New York.

- The vast majority of student loans are federal loans.

- Private student loans often supplement higher cost college of their choice.

- Private student loans have a significantly lower default rate than federal student loans.

- The federal government can recover defaulted student loans through administrative wage garnishment, offsetting federal tax refunds, and even part of Social Security checks.

- Seventy-two percent of college that they have paid off one-quarter Workforce Development.

- On average, Americans with a college degree are twice as likely to be employed as thenational average.

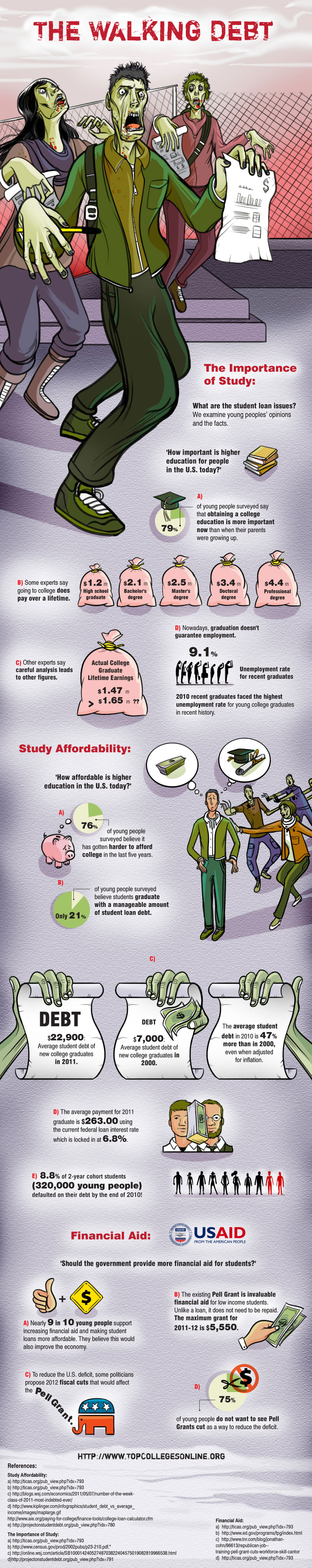

The Walking Debt [INFOGRAPHIC]

Waking up realizing you’re the only one alive and that you’re surrounded by fearsome Zombie horde – that’s exactly how you might feel waking up and realizing that you have an insane amount of debt. Debts- just like Walkers – are formidable and they will haunt you and devour you alive so it’s best to steer clear of them, or at least take control of them before they start to act nasty.

In a report, college students who graduated in 2011 had an average debt of $22,900 ($26,600 in a more recent report), and yet 79% of young people still believe that a college education is a valuable investment.

Check out the infographic below and learn more gruesome statistics about the rising student loan debt in the US.

Infographic brought to you by: Top Colleges Online

Saving for Your Children’s College Education | Nationwide Biweekly

Every parents want the best for their children. You work hard to make both ends meet in order to ensure that you are giving them the best future possible.

Because your child’s future depends on you, you should aim at giving them a good education. To get off to a good start in preparation for your children’s college education, be sure that you make it a part of your financial savings plan. Here are several ways you can save for your children’s education so you and your children can live a life that is debt-free and far from stress- as far as money is concerned, at least.

1. Start saving early

Cramming is never a good idea, and procrastination can be the most serious sin you can commit when planning for your children’s college education. Take this advice from nationally renowned financial guru, Dave Ramsey:

“Regardless of how you save for college, do it. Saving for college ensures that a legacy of debt is not passed down your family tree. Sadly, most people graduating from college right now are deeply in debt before they start. If you start early or save aggressively, your child will not be one of them”

2. Figure out the net cost

Are you planning to send your children to a public or private university? Before deciding, keep in mind that a higher cost does not necessarily mean better quality. Determine which institution will more adequately meet your children’s needs at a price affordable to you.

When figuring out the cost of colleges, take a look at the actual out-of-pocket cost for each school and not the sticker price. Overall, private colleges can be more expensive than in-state colleges. While both offer scholarships, most private colleges offer better financial aids than public universities.

3. Let your children know about your savings plan

Get your children involved early on in the saving process and make them understand how you are planning to save for their future education. Teach them the importance saving and help them develop a good saving habit.

When planning for your children’s future education, don’t get fooled into thinking student loans are the only option. The key is to start saving early and regularly. Have you started saving yet?

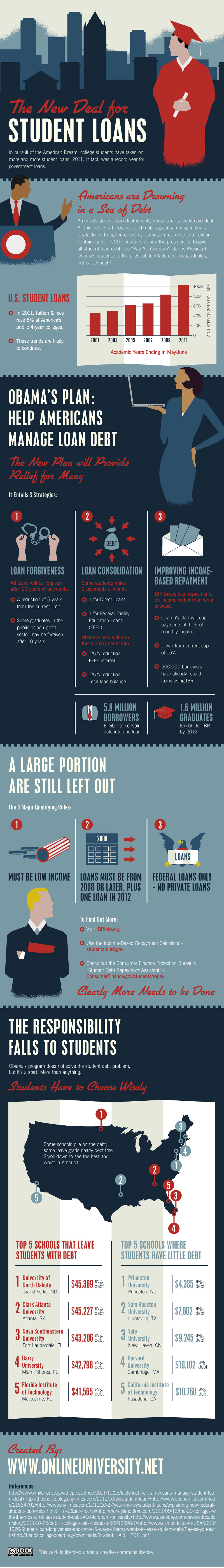

The New Deal for Student Loans

How bad is the student debt situation in America? In 2011, student loan debt reached a record high, surpassing credit card and auto loan debt. According to data gathered by Nationwide Biweekly Administration, with an average student loan of nearly $27,000, it is evident that students and their parents can’t keep up with the rising college cost, and it is burdening the students and the overall economy, as well.

How bad is the student debt situation in America? In 2011, student loan debt reached a record high, surpassing credit card and auto loan debt. According to data gathered by Nationwide Biweekly Administration, with an average student loan of nearly $27,000, it is evident that students and their parents can’t keep up with the rising college cost, and it is burdening the students and the overall economy, as well.

This infographic compiled by Online University takes a look at some grim statistics surrounding student loan and examines what the government is doing to curb student loans.