What is Nationwide Biweekly Administrations Biweekly Program?

Nationwide Biweekly Administration

Interest Minimizer Overview

(Transcription Below)

You’re about to learn one of the greatest financial secrets of our time. One that you can use to save thousands of dollars in interest charges. Each year, millions of Americans pay billions of dollars in unnecessary interest charges and lose out on growing their home equity much faster. How much money in equity are you losing to interest payments? Chances are it’s a lot more than you realize. For most of us, it’s thousands of dollars every year.

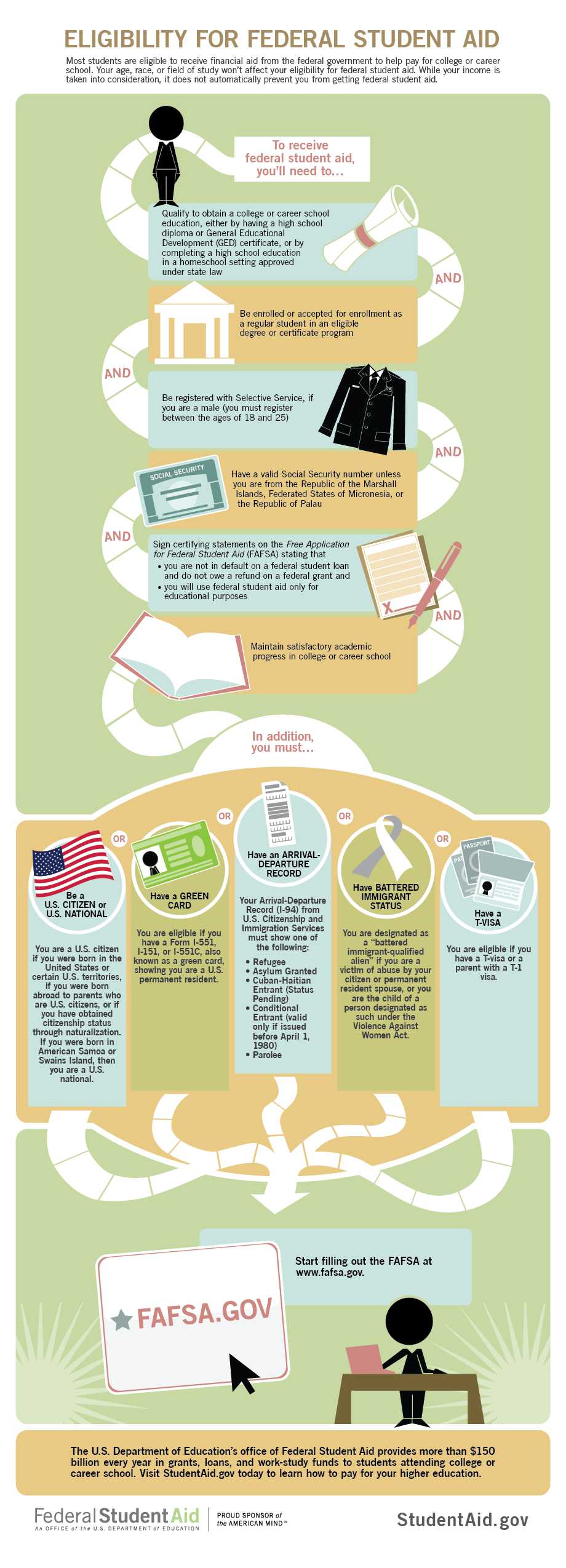

It doesn’t have to be that way. Most of us, we budget wisely, we shop for items on sale, and then we make sure we get a good deal for our hard-earned money. But when it comes to paying interest, most of us are needlessly giving away our money. Actually, losing it and we don’t know it. Fortunately there’s something you can do about it. The secret is the Interest Minimizer Program. A safe, convenient, and proven way to cut tens of thousands of dollars in interest charges off your existing loans including your mortgage, equity lines of credit, auto loans, student loans, and even credit card debt.

With the Interest Minimizer, your monthly payment is decreased to a much smaller bi-weekly amount and automatically debited every two weeks. We’ll conveniently match these debits to your pay schedule. Now, budgeting for a large mortgage payment has become a lot easier. No more checks to write or late fees to worry about. You’ll love how simple and easy it is. In fact, hundreds of thousands of American families are using the Interest Minimizer, saving billions of dollars in interest.

When you see the savings and how much you’ve been spending unnecessarily, you’ll want to sign up for the Interest Minimizer because the plan manages the bi-weekly or weekly schedule for you. Simply, painlessly, and automatically. Calculate your interest savings to see your specific savings. Or to speak with one of our friendly savings analysts, call the number on the screen. In just 10 minutes, we can show you how to stop overpaying interest and start saving money. Call us now.

Fast Facts About Student Loans

Fast Facts About Student Loans

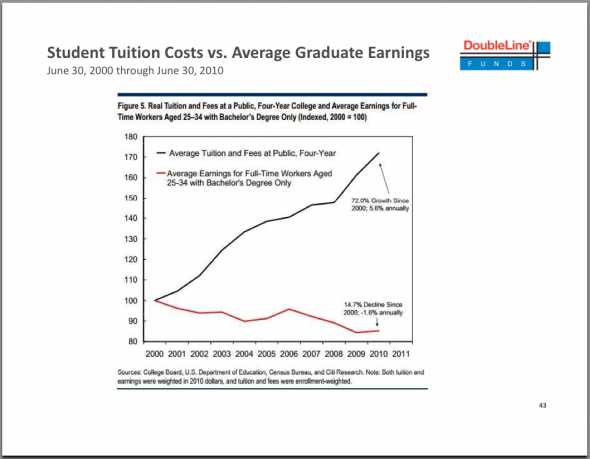

Now more than ever, student loans have become one of the biggest issues that Americans are facing. College cost are rising and outstanding student loans have grown to $1 trillion. And as if that is not worse enough, average graduate earnings of full-time employees aged 25-34 are falling, causing more student loan debtors to fall behind on their payments.

from the Business Insider article: GUNDLACH: These 4 Charts Show How Student Loans Have Become A Real Problem http://www.businessinsider.com/jeff-gundlachs-student-loan-charts-2012-12?op=1

If you are a student loan borrower yourself, read these fast facts on student loans from The Financial Services Roundtable. Be sure to visit their website to learn more about the student loan debt situation in the U.S.

- More Americans are attending college at a time when college is getting more expensive.

Many students borrow money to pay for a college degree.

- Student loans are now the largest form of consumer debt outside of home mortgages, eclipsing both auto loans and credit cards, according to the Federal Reserve Bank of New York.

- The vast majority of student loans are federal loans.

- Private student loans often supplement higher cost college of their choice.

- Private student loans have a significantly lower default rate than federal student loans.

- The federal government can recover defaulted student loans through administrative wage garnishment, offsetting federal tax refunds, and even part of Social Security checks.

- Seventy-two percent of college that they have paid off one-quarter Workforce Development.

- On average, Americans with a college degree are twice as likely to be employed as thenational average.

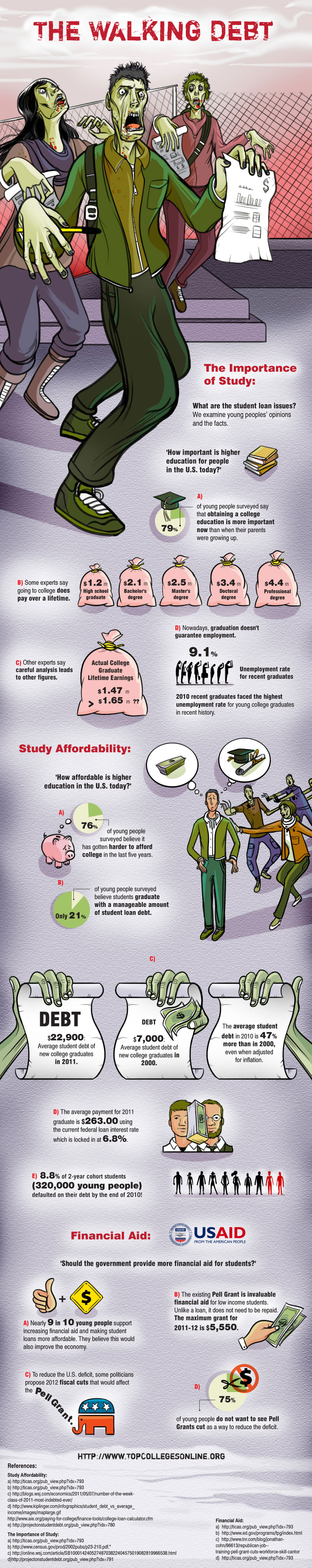

The Walking Debt [INFOGRAPHIC]

Waking up realizing you’re the only one alive and that you’re surrounded by fearsome Zombie horde – that’s exactly how you might feel waking up and realizing that you have an insane amount of debt. Debts- just like Walkers – are formidable and they will haunt you and devour you alive so it’s best to steer clear of them, or at least take control of them before they start to act nasty.

In a report, college students who graduated in 2011 had an average debt of $22,900 ($26,600 in a more recent report), and yet 79% of young people still believe that a college education is a valuable investment.

Check out the infographic below and learn more gruesome statistics about the rising student loan debt in the US.

Infographic brought to you by: Top Colleges Online

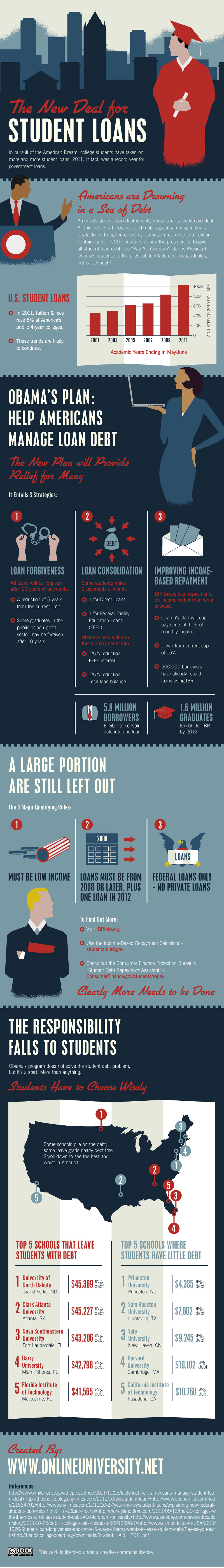

The New Deal for Student Loans

How bad is the student debt situation in America? In 2011, student loan debt reached a record high, surpassing credit card and auto loan debt. According to data gathered by Nationwide Biweekly Administration, with an average student loan of nearly $27,000, it is evident that students and their parents can’t keep up with the rising college cost, and it is burdening the students and the overall economy, as well.

How bad is the student debt situation in America? In 2011, student loan debt reached a record high, surpassing credit card and auto loan debt. According to data gathered by Nationwide Biweekly Administration, with an average student loan of nearly $27,000, it is evident that students and their parents can’t keep up with the rising college cost, and it is burdening the students and the overall economy, as well.

This infographic compiled by Online University takes a look at some grim statistics surrounding student loan and examines what the government is doing to curb student loans.

The Rise in Student Loan Debt – Will it be the Next Financial Crisis? | Nationwide Biweekly Administration

Today’s current Student Loan Debt has risen over $850 billion, the average person owing $27,000-$34,000.

College can be a very beneficial step taken in one’s life to achieve the dream job and life. However based on statistics, in 1992 there were 5.1 million unemployed college graduates in the U.S., and in 2008 there were 17 million unemployed college graduates in the US. Somehow everyone is going to be left with the obligation to repay this debt since there is little to no help, even if you file bankruptcy.

The rise in this debt over the last few years can be attributed to the unemployed adults returning to school to boost their skill sets in hopes of getting another job. You will have to repay these loans one way or another, making at least the minimum payment. There are many plans 0ut there available to help you pay back these loans in a timely and efficient manner. No doubt a plan like the ones offered by Nationwide Biweekly Administration could work within your current budget but also pay off your loan sooner and eliminates interest.

Biweekly Payment plans are available for student loans, and the plan works by taking your current monthly payment, cut it in half, and debits that amount every two weeks. Setting up this plan as an automatic debit can be matched up with your current pay schedule and permits no mistakes. Biweekly plans have been the focal point of many conversations on popular talk shows such as Oprah, CNN Money, and Wall Street Journal.

Call us at (800) 317-1756 to run a free analysis on your loan so we can see how the plan will be laid out and what options you have to accelerate the payoff of your Student Loan. You can also learn more by visiting InterestMinimizer.com.