Nationwide Biweekly Administration, Inc. Successfully Completes SSAE 16 Type II Audit

Nationwide Biweekly Administration, Inc. Successfully Completes SSAE 16 Type II Audit

November 18, 2013—Xenia, OH—Nationwide Biweekly Administration, Inc. (“NBA”), one of the nation’s largest and most recognized biweekly program administrators, announced today that it has successfully completed its first SSAE 16 Type II audit. NBA’s compliance with the SSAE 16 audit demonstrates its high level of commitment to solid operating procedures while maintaining the highest level of internal controls.

SSAE 16 is an internationally recognized third-party assurance audit for service providers. SSAE 16 is a new reporting standard for services organizations put forth by the Auditing Standards Board (ASB) of the American Institute of Certified Public Accountants (AICPA). As part of the audit, a number of operating controls related to NBA’s internal policies and procedures were examined. These controls include: company wide management systems, policies and procedures, network operations, customer data integrity and security, and computer controls.

“Receiving this important designation from a top auditing firm reaffirms NBA’s commitment to our customers and business partners, said Daniel Lipsky, President, NBA. “Through strict adherence to compliance and internal controls we’re able to provide peace of mind and world-class service to our customers.”

ABOUT NATIONWIDE BIWEEKLY ADMINISTRATION, INC.

Nationwide Biweekly Administration, Inc., located in Xenia, Ohio, provides payment service and processing to the general public through the Interest Minimizer program. Established in 2002, NBA is licensed and bonded and is registered with FinCEN as a money services business.

For more information about NBA, visit http://www.nbabiweekly.com, like the Facebook page at http://www.facebook.com/nationwidebiweekly.

What is Nationwide Biweekly Administrations Biweekly Program?

Nationwide Biweekly Administration

Interest Minimizer Overview

(Transcription Below)

You’re about to learn one of the greatest financial secrets of our time. One that you can use to save thousands of dollars in interest charges. Each year, millions of Americans pay billions of dollars in unnecessary interest charges and lose out on growing their home equity much faster. How much money in equity are you losing to interest payments? Chances are it’s a lot more than you realize. For most of us, it’s thousands of dollars every year.

It doesn’t have to be that way. Most of us, we budget wisely, we shop for items on sale, and then we make sure we get a good deal for our hard-earned money. But when it comes to paying interest, most of us are needlessly giving away our money. Actually, losing it and we don’t know it. Fortunately there’s something you can do about it. The secret is the Interest Minimizer Program. A safe, convenient, and proven way to cut tens of thousands of dollars in interest charges off your existing loans including your mortgage, equity lines of credit, auto loans, student loans, and even credit card debt.

With the Interest Minimizer, your monthly payment is decreased to a much smaller bi-weekly amount and automatically debited every two weeks. We’ll conveniently match these debits to your pay schedule. Now, budgeting for a large mortgage payment has become a lot easier. No more checks to write or late fees to worry about. You’ll love how simple and easy it is. In fact, hundreds of thousands of American families are using the Interest Minimizer, saving billions of dollars in interest.

When you see the savings and how much you’ve been spending unnecessarily, you’ll want to sign up for the Interest Minimizer because the plan manages the bi-weekly or weekly schedule for you. Simply, painlessly, and automatically. Calculate your interest savings to see your specific savings. Or to speak with one of our friendly savings analysts, call the number on the screen. In just 10 minutes, we can show you how to stop overpaying interest and start saving money. Call us now.

Nationwide Biweekly Administration Business Tour

Take a tour of Nationwide Biweekly Administration, and see why the administrator of Interest Minimizer bi-weekly mortgage program gets an A+ rating from the Better Business Bureau

(Transcription Below)

Welcome to the headquarters of Nationwide Biweekly Administration, an American company based in beautiful Xenia, Ohio. We’re proud to be the nation’s largest privately held bi-weekly payment administrator. As a fully licensed and bonded company registered with FinCEN as a money transmitter, we process billions of dollars in payments to over 5000 financial institutions. In fact, we process millions of transactions for hundreds of thousands of customers just like you.

When you partner with Nationwide Biweekly, you’ll quickly understand why our size, stability, quality, and professionalism have earned us an A+ rating from the Better Business Bureau. When you call to inquire about the benefits of our Interest Minimizer and Advanced Interest Minimizer programs, you are connected with one of our professionally trained savings analysts. They’re skilled at assisting people. And dramatically, reducing interest charges and paying off all kinds of debts faster including mortgages, home equity loans, credit cards, auto loans, student loans, virtually any interest bearing loan.

To ensure that we deliver world class service to you, Nationwide Biweekly hires only the best talent available in our area. That’s why we pay our savings analysts well above industry average which ensures high quality employees and low turnover. This means you will have professional, qualified, and enthusiastic people working on your behalf to save you from wasting money on unnecessary interest charges. Our savings analysts are provided a four-week classroom training program, ongoing mentor training and call monitoring, state of the art computers and software systems, access to our industry leading client management application, proprietary interest minimizer savings analysis software, professionally developed educational customer videos.

After you become a Nationwide Biweekly customer, you are assigned to our courteous and friendly customer service department. We ensure that Nationwide Biweekly has only the best, brightest, and most customer-oriented employees. It’s one of the keys to our success. During our rigorous three-step interview process, applicants are evaluated to ensure they have the aptitude and attitude to assist customers with their financial needs. The results of our commitment to providing high quality customer service have paid off. We randomly surveyed 743 of our customers and asked three important questions. Here are the results.

Was the representative professional and helpful? 99.3% of those surveyed answered yes. Are you satisfied with the benefits of the bi-weekly program? 97.3% answered yes. Would you recommend our company to someone else? 96.4% said, yes they’d recommend us. That’s quite a testament to our dedicated employees and their desire to deliver high levels of customer satisfaction and it means you can expect to receive this same level of customer service, too. We maintain this standard of excellence by having all employees undergo a rigorous training curriculum.

Once hired, new employees participate in a comprehensive 60-day orientation with the first 30 days spent in training classes being trained, mentored, and tested by our corporate trainers. As part of our ongoing training efforts, Nationwide Biweekly supervisors call our analysts and customer service representatives posing as actual customers to give them real world experience. We record the calls and play them back in one-on-one coaching sessions. That way, we ensure that not only are our representatives friendly, courteous, and professional, they are also knowledgeable and skilled at answering your questions.

Our employees genuinely enjoy working at Nationwide Biweekly and working with each other. Our facilities are designed to provide a safe, secure, and fun place to work. The bottom line is happy employees make better employees, and that benefits everyone. Thank you for taking a tour of Nationwide Biweekly, an American company offering innovative money saving services to hardworking people just like you. From our dedicated professional staff to our world-class customer service, industry leading tools and rigorous training, we are on a mission to help millions save billions.

Nationwide Biweekly Administration Earns BBB Accreditation

Nationwide Biweekly Administration Is Committed to BBB’s Standards of Trust

This week, Nationwide Biweekly Administration announced its recent Accreditation by your Better Business Bureau of Dayton/Miami Valley, Inc. As a BBB Accredited Business, Nationwide Biweekly Administration is dedicated to promoting trust in the marketplace. Its Accreditation will help people understand who the organization is and the core values it believes in. You can check out Nationwide Biweekly Administration’s BBB reliability report by visiting www.bbb.org or calling (937) 222-5825 or (800) 776-5301.

John North, BBB president and CEO, says, “BBB Accreditation is an honor. It’s voluntary and Accredited Businesses must meet and maintain your BBB’s Standards of Trust, a comprehensive set of policies, procedures and best practices representing trustworthiness in the marketplace. The standards call for building trust, embodying integrity, advertising honestly and telling the truth, being transparent, honoring promises, being responsive and safeguarding privacy.”

He continues, “Businesses that meet your BBB’s high standards are invited to apply for Accreditation. Applicants undergo a review process and ultimate approval by your BBB’s Board of Directors. According to Princeton Research, seven in ten consumers say they are more likely to buy from a company designated as a BBB Accredited Business.”

“We are proud to have met your BBB’s high standards and we’re excited to be part of an organization that exists so consumers and businesses alike have an unbiased source to guide them on matters of trust,” said Daniel Lipsky ”We value building trust with our customers and our Accreditation gives our customers confidence in our commitment to maintaining high ethical standards of conduct.”

Daniel Lipsky continues, “Our Accreditation signifies our commitment to customer service, reliability and trust. For any organization to excel in today’s environment, it’s critical it be fully committed to excellence. Our acknowledgement by your BBB aligns with and supports our efforts of providing superior service in the marketplace.”

About Nationwide Biweekly Administration

Nationwide Biweekly Administration is one of the nation’s largest and most recognized administrators for biweekly programs. Through their Interest Minimizer Program, NBA processes billions of dollars worth of mortgage payments for hundreds of thousands of customers. All payments are securely processed through the Federal ACH Banking System with their banking partners.

Easy Ways You Can Save Thousands of Dollars in 2013

Easy Ways You Can Save Thousands of Dollars in 2013

If your money situation during the past years was a mess, think of 2013 as a good chance to kick poor financial habits and manage your money wisely. Here’s your guide to a better money situation this year:

- When buying items online, always check for special offers and discount codes. Check for sales online before doing your shopping. However, you need to be careful not to purchase more than what you need. Some people spend too much instead of saving more by making unnecessary and unplanned purchases. Prioritize based on budget and avoid impulsive shopping.

- Reduce, reuse and recycle. By doing these three you can make a lot of difference: you save money and you help the environment. Reduce your waste, reuse or repair old items and buy more recycled products.

- Opt for generic drugs which are cheaper alternative for branded medicines. You don’t have to worry about quality; generic drugs are also regulated by the Food and Drug Administration and they are proven safe and effective.

- Make your own packed lunch. It would surprise you how a cup of coffee and a sandwich at work can add up to a huge amount of money over time. Instead of buying food or eating on a restaurant every single day, make your own lunch at home and bring to work.

- Save money on electric bills. Unplug appliances and turn off lights that are not in use. In the winter, wear warm clothing and set your thermostat to 68 degrees or lower during the day.

- If possible, walk or ride your bike to work. This way, you are able to save money on gas and get some exercise.

- The easiest way to save money? Avoid extra finance charges by paying fees on time. Missing a payment can cost you more money and may have a negative effect on your credit rating.

Looking for a company to handle your biweekly payments? Nationwide Biweekly Administration has the only biweekly program that provides a 100% money back savings guarantee. For more information visit http://www.nbabiweekly.com today!

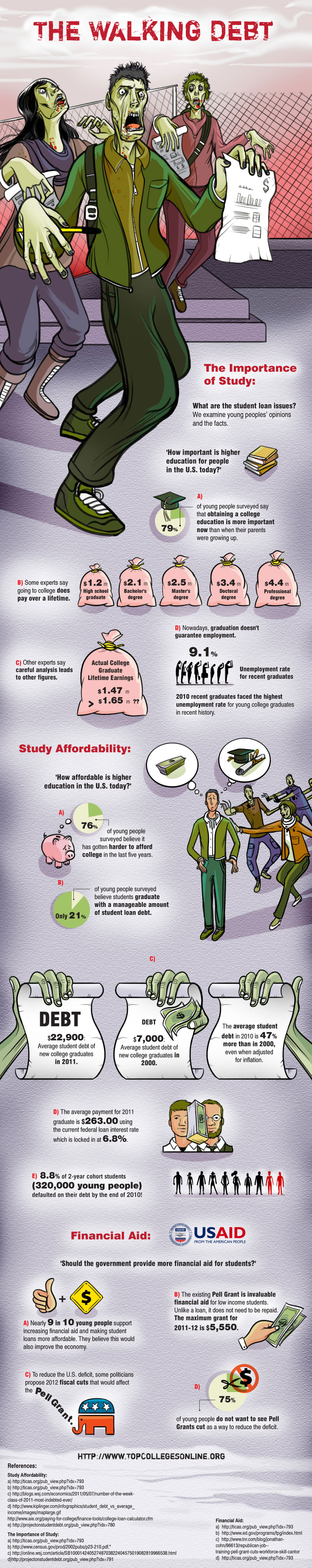

The Walking Debt [INFOGRAPHIC]

Waking up realizing you’re the only one alive and that you’re surrounded by fearsome Zombie horde – that’s exactly how you might feel waking up and realizing that you have an insane amount of debt. Debts- just like Walkers – are formidable and they will haunt you and devour you alive so it’s best to steer clear of them, or at least take control of them before they start to act nasty.

In a report, college students who graduated in 2011 had an average debt of $22,900 ($26,600 in a more recent report), and yet 79% of young people still believe that a college education is a valuable investment.

Check out the infographic below and learn more gruesome statistics about the rising student loan debt in the US.

Infographic brought to you by: Top Colleges Online