Nationwide Biweekly Administration, Inc. Successfully Completes SSAE 16 Type II Audit

Nationwide Biweekly Administration, Inc. Successfully Completes SSAE 16 Type II Audit

November 18, 2013—Xenia, OH—Nationwide Biweekly Administration, Inc. (“NBA”), one of the nation’s largest and most recognized biweekly program administrators, announced today that it has successfully completed its first SSAE 16 Type II audit. NBA’s compliance with the SSAE 16 audit demonstrates its high level of commitment to solid operating procedures while maintaining the highest level of internal controls.

SSAE 16 is an internationally recognized third-party assurance audit for service providers. SSAE 16 is a new reporting standard for services organizations put forth by the Auditing Standards Board (ASB) of the American Institute of Certified Public Accountants (AICPA). As part of the audit, a number of operating controls related to NBA’s internal policies and procedures were examined. These controls include: company wide management systems, policies and procedures, network operations, customer data integrity and security, and computer controls.

“Receiving this important designation from a top auditing firm reaffirms NBA’s commitment to our customers and business partners, said Daniel Lipsky, President, NBA. “Through strict adherence to compliance and internal controls we’re able to provide peace of mind and world-class service to our customers.”

ABOUT NATIONWIDE BIWEEKLY ADMINISTRATION, INC.

Nationwide Biweekly Administration, Inc., located in Xenia, Ohio, provides payment service and processing to the general public through the Interest Minimizer program. Established in 2002, NBA is licensed and bonded and is registered with FinCEN as a money services business.

For more information about NBA, visit http://www.nbabiweekly.com, like the Facebook page at http://www.facebook.com/nationwidebiweekly.

What is Nationwide Biweekly Administrations Biweekly Program?

Nationwide Biweekly Administration

Interest Minimizer Overview

(Transcription Below)

You’re about to learn one of the greatest financial secrets of our time. One that you can use to save thousands of dollars in interest charges. Each year, millions of Americans pay billions of dollars in unnecessary interest charges and lose out on growing their home equity much faster. How much money in equity are you losing to interest payments? Chances are it’s a lot more than you realize. For most of us, it’s thousands of dollars every year.

It doesn’t have to be that way. Most of us, we budget wisely, we shop for items on sale, and then we make sure we get a good deal for our hard-earned money. But when it comes to paying interest, most of us are needlessly giving away our money. Actually, losing it and we don’t know it. Fortunately there’s something you can do about it. The secret is the Interest Minimizer Program. A safe, convenient, and proven way to cut tens of thousands of dollars in interest charges off your existing loans including your mortgage, equity lines of credit, auto loans, student loans, and even credit card debt.

With the Interest Minimizer, your monthly payment is decreased to a much smaller bi-weekly amount and automatically debited every two weeks. We’ll conveniently match these debits to your pay schedule. Now, budgeting for a large mortgage payment has become a lot easier. No more checks to write or late fees to worry about. You’ll love how simple and easy it is. In fact, hundreds of thousands of American families are using the Interest Minimizer, saving billions of dollars in interest.

When you see the savings and how much you’ve been spending unnecessarily, you’ll want to sign up for the Interest Minimizer because the plan manages the bi-weekly or weekly schedule for you. Simply, painlessly, and automatically. Calculate your interest savings to see your specific savings. Or to speak with one of our friendly savings analysts, call the number on the screen. In just 10 minutes, we can show you how to stop overpaying interest and start saving money. Call us now.

Educate your kids financially

You can never teach your children about money too soon!

You may have noticed, children may act as money grows on trees! Kids may be aware that you go to the bank to get money, but rarely they know how the money gets there. This is the perfect opportunity to teach your kids that you have to work hard to earn the money that you spend. Once they understand this concept they may become aware of the hard work you put in to earn a living.

Once they learn, they will apply

After your kids learn about money, how its earned, and the things it can buy; you might notice they will save every penny they can get their hands on. As a parent it is your responsibility to channel the attitude to teach them to save and learn delayed gratification.

-Planting the seeds early will help bear fruit later

Educate your children from a young age on how money is earned and how it works. By doing this you can avoid trying to teach them as teenagers, when they are less likely to heed any kind of advice you give.

Allowance can be an effective teaching tool

Giving your kids a small amount of money at a young age will prep them for the larger future numbers to come.

The teaching game changes with Teenagers and College-age kids

By the time the kids reach this age group they will most likely have bigger responsibilities such as: Checking accounts, Credit Cards, and other debt. Teaching the kids about banking and credit while in high school will set them on the path of success when they venture out on there own. High School, a lot of times, will off classes covering banking, financing, and the market. Teach your children to take advantage of these resources.

Videos About the Benefits of Biweekly Savings Programs

Want to hear what others have to say about the benefits of biweekly savings programs? The interest savings and reduced years to pay off your loan are so incredible even Oprah Winfrey and the CBS Evening News have done stories on it. But don’t take our word for it, click the videos below to see for yourself.

For more information about Nationwide Biweekly Administration you can visit http://www.interestminimizer.com/ or call 1-888-802-1296

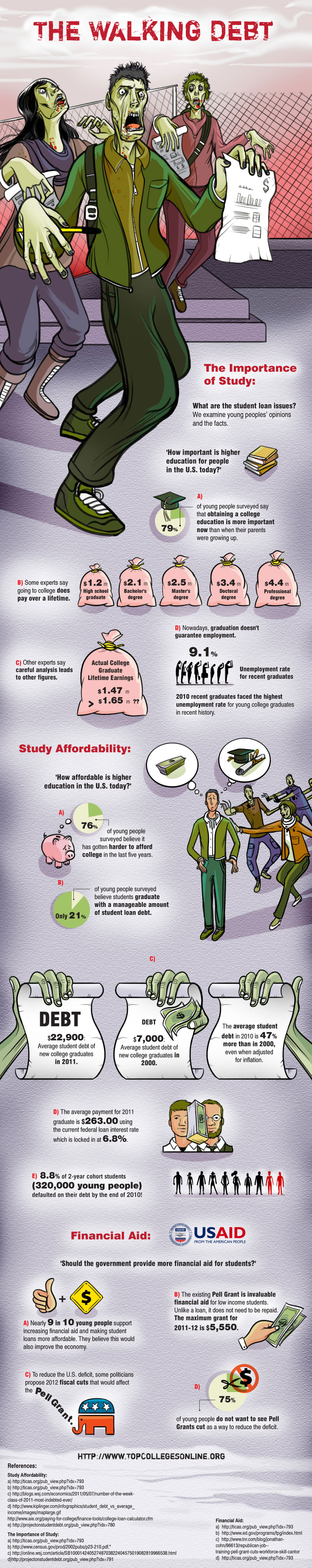

The Walking Debt [INFOGRAPHIC]

Waking up realizing you’re the only one alive and that you’re surrounded by fearsome Zombie horde – that’s exactly how you might feel waking up and realizing that you have an insane amount of debt. Debts- just like Walkers – are formidable and they will haunt you and devour you alive so it’s best to steer clear of them, or at least take control of them before they start to act nasty.

In a report, college students who graduated in 2011 had an average debt of $22,900 ($26,600 in a more recent report), and yet 79% of young people still believe that a college education is a valuable investment.

Check out the infographic below and learn more gruesome statistics about the rising student loan debt in the US.

Infographic brought to you by: Top Colleges Online

The Rise in Student Loan Debt – Will it be the Next Financial Crisis? | Nationwide Biweekly Administration

Today’s current Student Loan Debt has risen over $850 billion, the average person owing $27,000-$34,000.

College can be a very beneficial step taken in one’s life to achieve the dream job and life. However based on statistics, in 1992 there were 5.1 million unemployed college graduates in the U.S., and in 2008 there were 17 million unemployed college graduates in the US. Somehow everyone is going to be left with the obligation to repay this debt since there is little to no help, even if you file bankruptcy.

The rise in this debt over the last few years can be attributed to the unemployed adults returning to school to boost their skill sets in hopes of getting another job. You will have to repay these loans one way or another, making at least the minimum payment. There are many plans 0ut there available to help you pay back these loans in a timely and efficient manner. No doubt a plan like the ones offered by Nationwide Biweekly Administration could work within your current budget but also pay off your loan sooner and eliminates interest.

Biweekly Payment plans are available for student loans, and the plan works by taking your current monthly payment, cut it in half, and debits that amount every two weeks. Setting up this plan as an automatic debit can be matched up with your current pay schedule and permits no mistakes. Biweekly plans have been the focal point of many conversations on popular talk shows such as Oprah, CNN Money, and Wall Street Journal.

Call us at (800) 317-1756 to run a free analysis on your loan so we can see how the plan will be laid out and what options you have to accelerate the payoff of your Student Loan. You can also learn more by visiting InterestMinimizer.com.