Nationwide Biweekly Administration, Inc. Successfully Completes SSAE 16 Type II Audit

Nationwide Biweekly Administration, Inc. Successfully Completes SSAE 16 Type II Audit

November 18, 2013—Xenia, OH—Nationwide Biweekly Administration, Inc. (“NBA”), one of the nation’s largest and most recognized biweekly program administrators, announced today that it has successfully completed its first SSAE 16 Type II audit. NBA’s compliance with the SSAE 16 audit demonstrates its high level of commitment to solid operating procedures while maintaining the highest level of internal controls.

SSAE 16 is an internationally recognized third-party assurance audit for service providers. SSAE 16 is a new reporting standard for services organizations put forth by the Auditing Standards Board (ASB) of the American Institute of Certified Public Accountants (AICPA). As part of the audit, a number of operating controls related to NBA’s internal policies and procedures were examined. These controls include: company wide management systems, policies and procedures, network operations, customer data integrity and security, and computer controls.

“Receiving this important designation from a top auditing firm reaffirms NBA’s commitment to our customers and business partners, said Daniel Lipsky, President, NBA. “Through strict adherence to compliance and internal controls we’re able to provide peace of mind and world-class service to our customers.”

ABOUT NATIONWIDE BIWEEKLY ADMINISTRATION, INC.

Nationwide Biweekly Administration, Inc., located in Xenia, Ohio, provides payment service and processing to the general public through the Interest Minimizer program. Established in 2002, NBA is licensed and bonded and is registered with FinCEN as a money services business.

For more information about NBA, visit http://www.nbabiweekly.com, like the Facebook page at http://www.facebook.com/nationwidebiweekly.

What is Nationwide Biweekly Administrations Biweekly Program?

Nationwide Biweekly Administration

Interest Minimizer Overview

(Transcription Below)

You’re about to learn one of the greatest financial secrets of our time. One that you can use to save thousands of dollars in interest charges. Each year, millions of Americans pay billions of dollars in unnecessary interest charges and lose out on growing their home equity much faster. How much money in equity are you losing to interest payments? Chances are it’s a lot more than you realize. For most of us, it’s thousands of dollars every year.

It doesn’t have to be that way. Most of us, we budget wisely, we shop for items on sale, and then we make sure we get a good deal for our hard-earned money. But when it comes to paying interest, most of us are needlessly giving away our money. Actually, losing it and we don’t know it. Fortunately there’s something you can do about it. The secret is the Interest Minimizer Program. A safe, convenient, and proven way to cut tens of thousands of dollars in interest charges off your existing loans including your mortgage, equity lines of credit, auto loans, student loans, and even credit card debt.

With the Interest Minimizer, your monthly payment is decreased to a much smaller bi-weekly amount and automatically debited every two weeks. We’ll conveniently match these debits to your pay schedule. Now, budgeting for a large mortgage payment has become a lot easier. No more checks to write or late fees to worry about. You’ll love how simple and easy it is. In fact, hundreds of thousands of American families are using the Interest Minimizer, saving billions of dollars in interest.

When you see the savings and how much you’ve been spending unnecessarily, you’ll want to sign up for the Interest Minimizer because the plan manages the bi-weekly or weekly schedule for you. Simply, painlessly, and automatically. Calculate your interest savings to see your specific savings. Or to speak with one of our friendly savings analysts, call the number on the screen. In just 10 minutes, we can show you how to stop overpaying interest and start saving money. Call us now.

Videos About the Benefits of Biweekly Savings Programs

Want to hear what others have to say about the benefits of biweekly savings programs? The interest savings and reduced years to pay off your loan are so incredible even Oprah Winfrey and the CBS Evening News have done stories on it. But don’t take our word for it, click the videos below to see for yourself.

For more information about Nationwide Biweekly Administration you can visit http://www.interestminimizer.com/ or call 1-888-802-1296

Is Nationwide Biweekly Administration a Scam?

Today’s post is an explanation of articles you may have seen or run into when you do a search on Nationwide Biweekly Administration. It is amazing how a handful of people who have not fully researched the company can post a blog on the internet and misrepresent them. I find these articles to be as believable as the National Enquirer and they have very little solid information to back them up. With this said I have legitimate research to back up everything that has been said and to prove that Nationwide Biweekly Administration is NOT A SCAM.

The first item I want to discuss is the way NBA may market to potential customers. Some of you may have received a letter with the name of your lender on top that explains how NBA can save you money on your mortgage with their interest minimizer program. This letter is not intended to “trick you”. The reason why your lender is on the top of the page simply shows you that NBA administers the program to your lender as well as over 5,000 other lenders. If you so choose to call you will be connected to their customer service departments which can run a savings analysis report on your mortgage or any other type of loan you are trying to pay off early.

The first item I want to discuss is the way NBA may market to potential customers. Some of you may have received a letter with the name of your lender on top that explains how NBA can save you money on your mortgage with their interest minimizer program. This letter is not intended to “trick you”. The reason why your lender is on the top of the page simply shows you that NBA administers the program to your lender as well as over 5,000 other lenders. If you so choose to call you will be connected to their customer service departments which can run a savings analysis report on your mortgage or any other type of loan you are trying to pay off early.

The second point I want to make is the trust issue with NBA. If there is any biweekly program company that you can trust with making sure your payment is applied properly and on time, it’s NBA. Why do I say that? Well first off, they are one of the nation’s largest and most recognized independent processors. They are fully licensed, bonded, and registered with FinCEN – the Financial Crimes Enforcement Network – as a Money Services Business. On top of that they are also listed with Dunn & Bradstreet and the Better Business Bureau. But what I really find interesting is they are the only biweekly company that has been independently audited by the C.P.A. Firm of Flagel, Huber, Flagel, & Company. As you can see in this video they earned a Gold Seal of Approval documenting that their savings estimates are accurate, funds are protected by FDIC Insured Banks, client’s funds are being remitted to lenders accurately and timely, and their program operates as indicated in contracts. To top off any more trust issues you may have, their corporate office is located in the State of Ohio and is audited annually by the State to ensure strict compliance to all State and Federal Regulations. All payments are securely processed through the Federal ACH Banking System, and enjoy protection under Regulation “E” of the Federal Reserve. Under Regulation “E,” funds debited from your account are protected against fraud or loss for a period of 60 days from the drafting date. You are completely protected & have nothing to worry about with NBA.

My last point that will be covered pertains to the articles on how biweekly programs are nothing but a scam or something that you shouldn’t need to pay someone to do because you can do it yourself. For the sake of these articles I am going to sum it up for you and assure you that biweekly programs are NOT a scam. You see, in a perfect little world we would do everything ourselves. In the morning we could jump right of bed into our workout clothes and hit the weights for 30 minutes. Then we could hurry up and cut the grass before heading into work. During lunch we could rush home and change our oil. Then once the work day is finished we could clean the pool out and maybe even give the dog a bath and a quick trim. Sounds ridiculous doesn’t it? It’s a good thing that we have people that can actually help provide us with convenience, discipline, and structure so we can stay on track and not have to do everything on our own. This is how I see what a biweekly program can do for people. Of course this is something that every one of us can do. How simple can it be to make an extra payment a year? Well I guess not that simple since less than 1% of Americans prepay their mortgages every year. Lets be honest, if anyone of us had extra money that equaled our mortgage payment I doubt that making an extra payment towards it would be the first thing on your list. So if you think that Nationwide Biweekly Administration is a scam then so is your personal trainer, lawn cutting service, guy that changes your oil, pool boy, and dog groomer. These are all helpful services that are provided for those who want them. If you would like to talk about scams go ahead and check how much interest you will be paying your bank once you pay off your loan. I guarantee you will be giving them thousands of dollars more then you would ever give a company that provides a biweekly program.

I hope this sums up some of the articles you may have read and would love to see some POSITIVE comments on how using a biweekly program has helped you out.

For more information about Nationwide Biweekly Administration you can visit http://www.interestminimizer.com/ or call 1-888-802-1296

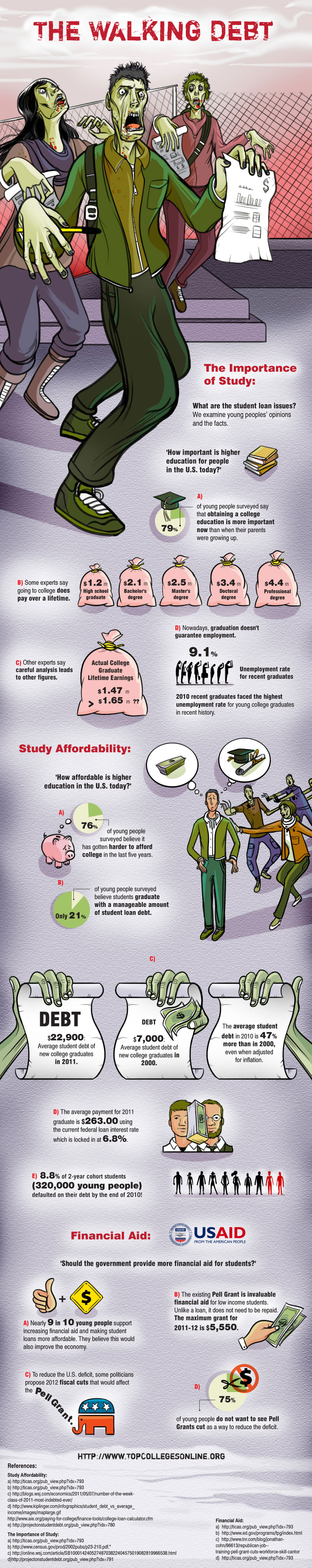

The Walking Debt [INFOGRAPHIC]

Waking up realizing you’re the only one alive and that you’re surrounded by fearsome Zombie horde – that’s exactly how you might feel waking up and realizing that you have an insane amount of debt. Debts- just like Walkers – are formidable and they will haunt you and devour you alive so it’s best to steer clear of them, or at least take control of them before they start to act nasty.

In a report, college students who graduated in 2011 had an average debt of $22,900 ($26,600 in a more recent report), and yet 79% of young people still believe that a college education is a valuable investment.

Check out the infographic below and learn more gruesome statistics about the rising student loan debt in the US.

Infographic brought to you by: Top Colleges Online

The Rise in Student Loan Debt – Will it be the Next Financial Crisis? | Nationwide Biweekly Administration

Today’s current Student Loan Debt has risen over $850 billion, the average person owing $27,000-$34,000.

College can be a very beneficial step taken in one’s life to achieve the dream job and life. However based on statistics, in 1992 there were 5.1 million unemployed college graduates in the U.S., and in 2008 there were 17 million unemployed college graduates in the US. Somehow everyone is going to be left with the obligation to repay this debt since there is little to no help, even if you file bankruptcy.

The rise in this debt over the last few years can be attributed to the unemployed adults returning to school to boost their skill sets in hopes of getting another job. You will have to repay these loans one way or another, making at least the minimum payment. There are many plans 0ut there available to help you pay back these loans in a timely and efficient manner. No doubt a plan like the ones offered by Nationwide Biweekly Administration could work within your current budget but also pay off your loan sooner and eliminates interest.

Biweekly Payment plans are available for student loans, and the plan works by taking your current monthly payment, cut it in half, and debits that amount every two weeks. Setting up this plan as an automatic debit can be matched up with your current pay schedule and permits no mistakes. Biweekly plans have been the focal point of many conversations on popular talk shows such as Oprah, CNN Money, and Wall Street Journal.

Call us at (800) 317-1756 to run a free analysis on your loan so we can see how the plan will be laid out and what options you have to accelerate the payoff of your Student Loan. You can also learn more by visiting InterestMinimizer.com.