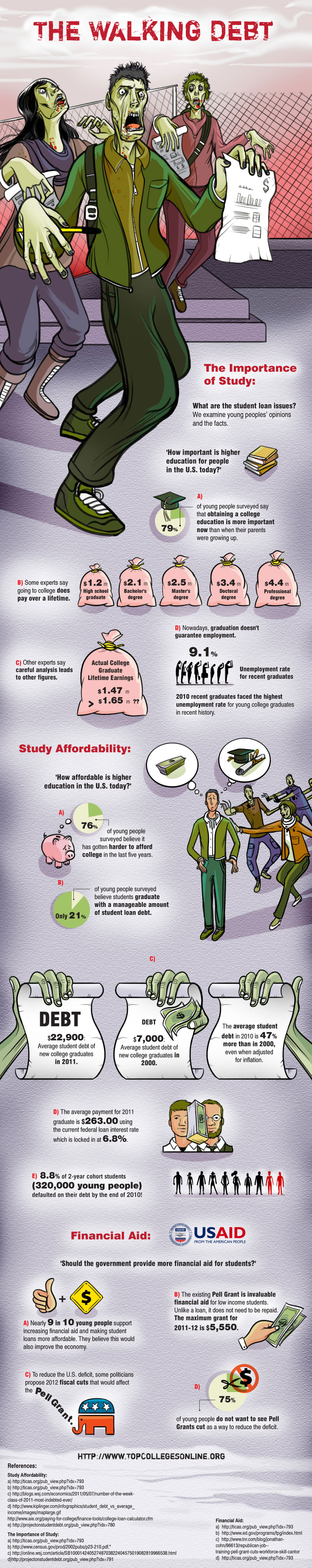

Waking up realizing you’re the only one alive and that you’re surrounded by fearsome Zombie horde – that’s exactly how you might feel waking up and realizing that you have an insane amount of debt. Debts- just like Walkers – are formidable and they will haunt you and devour you alive so it’s best to steer clear of them, or at least take control of them before they start to act nasty.

In a report, college students who graduated in 2011 had an average debt of $22,900 ($26,600 in a more recent report), and yet 79% of young people still believe that a college education is a valuable investment.

Check out the infographic below and learn more gruesome statistics about the rising student loan in the US.

Infographic brought to you by: Top Colleges Online