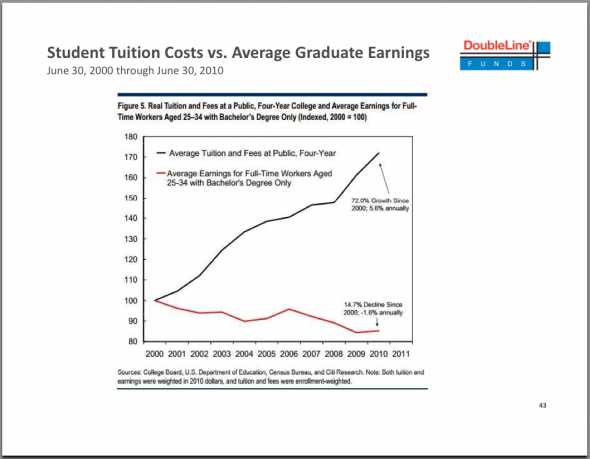

Now more than ever, student loans have become one of the biggest issues that Americans are facing. College cost are rising and outstanding student loans have grown to $1 trillion. And as if that is not worse enough, average graduate earnings of full-time employees aged 25-34 are falling, causing more student loan debtors to fall behind on their payments.

from the Business Insider article: GUNDLACH: These 4 Charts Show How Student Loans Have Become A Real Problem http://www.businessinsider.com/jeff-gundlachs-student-loan-charts-2012-12?op=1

If you are a student loan borrower yourself, read these fast facts on student loans from The Financial Services Roundtable. Be sure to visit their website to learn more about the student loan debt situation in the U.S.

- More Americans are attending college at a time when college is getting more expensive.

Many students borrow money to pay for a college degree.

- Student loans are now the largest form of consumer debt outside of home mortgages, eclipsing both auto loans and credit cards, according to the Federal Reserve Bank of New York.

- The vast majority of student loans are federal loans.

- Private student loans often supplement higher cost college of their choice.

- Private student loans have a significantly lower default rate than federal student loans.

- The federal government can recover defaulted student loans through administrative wage garnishment, offsetting federal tax refunds, and even part of Social Security checks.

- Seventy-two percent of college that they have paid off one-quarter Workforce Development.

- On average, Americans with a college degree are twice as likely to be employed as thenational average.

Related posts:

Comments

Powered by Facebook Comments